salt tax deduction limit

It contains 433 billion in gross new spending and targeted tax credits mainly for alternative energy. While other states are considering workarounds to the Tax Cut and Jobs Acts TCJA 10000 annual limit on the federal deduction for state and local taxes SALT on individual income tax.

Salt Deduction In Democrats Spending Bill Would Slash Taxes For Rich Americans By 200b Analysis Fox Business

The federal tax reform law passed on Dec.

:max_bytes(150000):strip_icc()/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

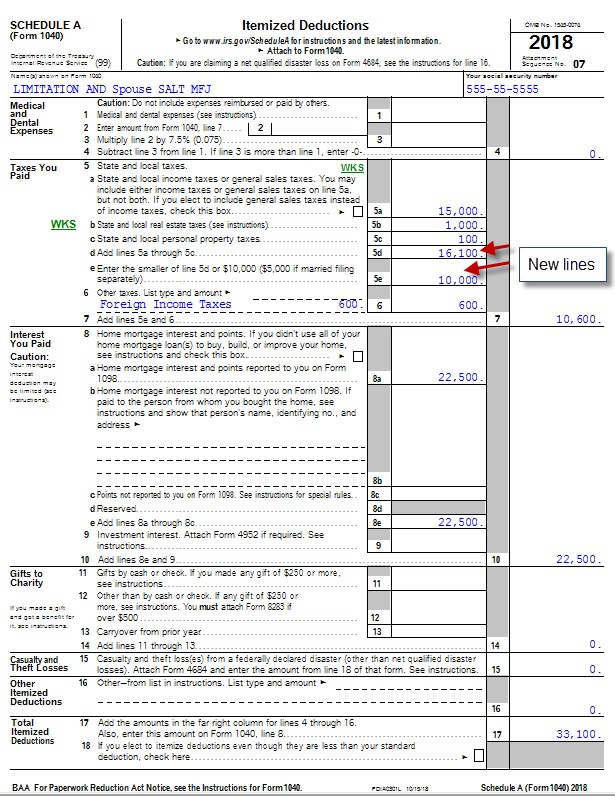

. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. The SALT limit really put an unfair burden on all of our cities and towns. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000.

IR-2019-59 March 29 2019 The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local. But you must itemize in order to deduct state and local taxes on your federal income tax return. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

House Democrats spending package raises the SALT deduction limit to 80000 through 2030. The SALT deduction limit was part of a larger change to the individual income tax. Supreme Court has rejected a challenge from New York and three other states to overturn the 10000 limit on the federal deduction for state and local taxes which is known as.

The SALT Tax deduction limit or cap was set at 10000 dollars in 2017 but this was set to expire in 2026 and become uncapped. The Tax Cuts and Jobs Act imposed a 10000 limit on the SALT deduction so regardless of how much you actually pay in state and local taxes youre only allowed to deduct a maximum of. What is the SALT deduction limit.

The 10000 limit on SALT deductions has a. Previously the deduction was unlimited. Unchanged is the state and local income tax SALT deduction cap.

As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround. One draft proposal floats 120 billion to lift the cap on state tax deductions for incomes up to about 400000. New limits for SALT tax write off.

The Tax Cuts and Jobs Act TCJA limited the amount an individual can deduct from the amount of the following state and local taxes they paid during. The federal government enacted a 10000 limit for joint. This will leave some high-income filers with a higher.

The state and local tax deduction commonly called the SALT deduction is a federal deduction that allows you to deduct the amount you pay in taxes to your state or local governments. To be impacted by the limit 3 things must. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. The new proposal from the Democrats raises the cap to 80000. This significantly increases the boundary that put a cap on the SALT.

The TCJA lowered tax rates and expanded the standard deduction to 12000 for single filers and. The ability to deduct state and local taxes SALT has historically been a valuable tax break for taxpayers who itemize deductions on their federal income tax returns. Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file.

The Tax Cuts and Jobs Act. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. The law known as the Tax Cuts and Jobs Act TCJA PL.

The change may be significant for filers who itemize deductions in high-tax. 115 - 97 imposed a 10000 cap on the deduction for aggregated SALT income tax sales tax real property tax and personal property. The Tax Cuts and Jobs Act of 2017 placed a 10000 cap on State and Local Tax SALT deductions.

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

How Tax Reform Affects The State And Local Tax Salt Deduction Tax Pro Center Intuit

Salt Cap Workarounds Will They Work Accounting Today

Democratic States Battle Over Salt Tax Rules

How Does The State And Local Tax Deduction Work Ramsey

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

Salt Deduction Limit Avoiding The 10 000 Federal Limitation In New York

Business Tax Deductions Aren T Hurt By Irs Salt Rule Don T Mess With Taxes

Finally A Solution To The Limits On State And Local Tax Deductions Morningstar

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

State And Local Taxes What Is The Salt Deduction

Dueling Salt Fixes In Play As Democrats Try To Close Budget Deal Roll Call

Salt Is A Wound Both Sides Of The Aisle Upset With Tax Deduction Plan In Bbb Act Pittsburgh Post Gazette

House Democrats Push For Salt Relief In Appropriations Bill

S Corp Workaround For Salt Deduction Cap Wcre

Pass Through Entity Tax Treatment Legislation Sweeping Across States Forvis

State And Local Tax Salt Deduction What It Is How It Works Bankrate